How MTS Works

How MTS Works

MTS (Market Trend System) is a market-structure and risk-evaluation framework. It helps users understand what the market is doing before taking decisions.

MTS Market Structure

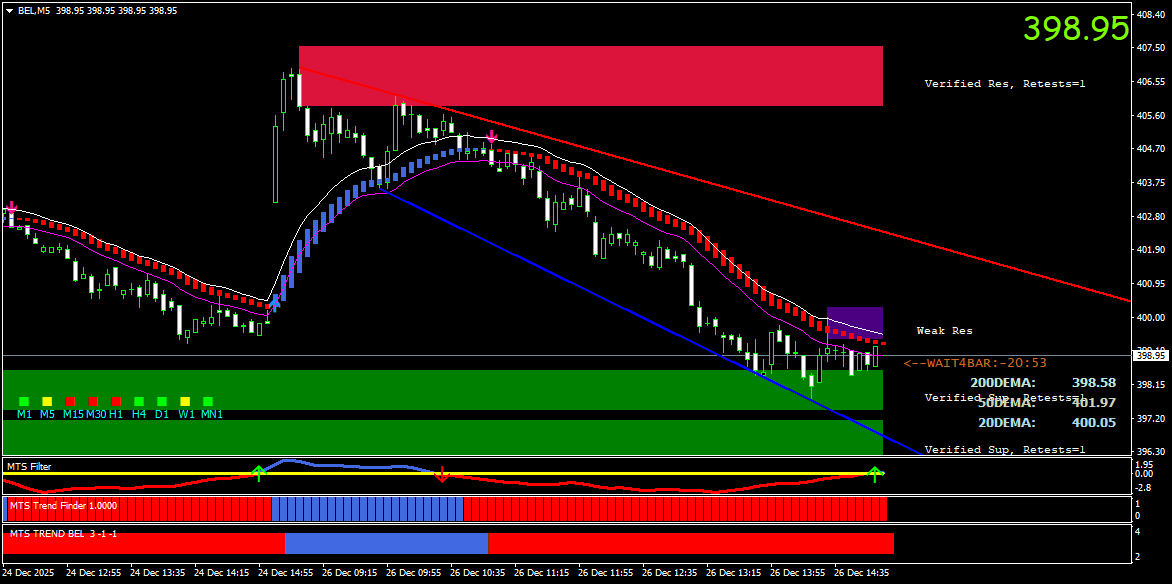

Illustrative market structure (red = resistance, blue = support)

The chart illustrates how MTS interprets price behaviour using automatically generated trendlines, structural zones, and trend-momentum filters.

- Red trendline: Automatically projected resistance

- Blue trendline: Dynamically identified support

- Green zone: Structural demand area

- Trend & momentum filters: Validate participation strength

- No manual plotting: Entire structure adapts automatically

This illustration is for explanation only. It is not a trade signal or recommendation.

Full Explanation Sheet – How to Use MTS

1. Market Environment Identification

Markets move through different phases. MTS classifies trending, momentum-driven, or sideways environments.

- Trending environments support continuation logic

- Sideways environments require restraint

- Same approach is not applied everywhere

2. Multi-Timeframe Alignment

MTS evaluates structure across higher, intermediate, and lower timeframes.

- Alignment improves clarity

- Conflict increases noise

- Alignment prioritised over frequency

3. Momentum Strength Evaluation

MTS evaluates whether momentum supports continuation or is weakening.

- Strong momentum confirms participation

- Weak momentum signals caution

- Avoid low-quality conditions

4. Structural Zones & Trendlines

Support-resistance zones and trendlines are identified automatically.

- Zones define risk invalidation areas

- Trendlines adapt dynamically

- No manual plotting required

5. Risk-First Framework

Risk assessment is central to MTS participation logic.

- Risk defined before opportunity

- Capital protection prioritised

- Standing aside is valid

6. Sectoral & Multi-Asset Scanning

MTS scans across sectors and instruments displaying structure.

- Scanning reduces noise

- Helps prioritise attention

- Does not encourage over-activity